Need to understand Cipro sales trends? Focus on analyzing prescription data from major pharmaceutical databases like IQVIA and Symphony Health. These resources offer granular insights into market share, regional variations, and sales performance by specific dosage forms.

Direct-to-consumer advertising (DTC) significantly impacts Cipro sales. Monitor DTC campaigns across various media–television, print, and digital–to identify successful strategies and understand their impact on prescription volume. Track social media mentions and sentiment analysis for potential sales drivers or roadblocks.

Competitive analysis is key. Regularly review sales data for competing antibiotics to assess market positioning and identify opportunities. Consider factors like pricing, formulation, and indication claims to understand Cipro’s competitive advantage.

Remember: Sales forecasting models, incorporating historical sales data, market trends, and competitor analysis, provide crucial insights for optimizing marketing strategies and inventory management. Regularly refine your model for greater accuracy.

Actionable advice: Invest in sophisticated data analytics tools to process and interpret the large volume of sales data efficiently. This will enable faster, more informed decision-making regarding pricing, marketing, and distribution.

- Cipro Sales: A Detailed Overview

- Cipro’s Market Share and Competition

- Generic Competition’s Impact

- Other Competitive Threats

- Future Outlook

- Factors Influencing Cipro Sales Growth

- Market Competition and Pricing Strategies

- Regulatory Changes and Clinical Trials

- Geographic Distribution of Cipro Sales

- Cipro Sales and the Rise of Antibiotic Resistance

- Understanding the Connection

- Mitigating the Problem

- Future Outlook for Cipro Sales

Cipro Sales: A Detailed Overview

Analyzing Cipro sales requires a multi-faceted approach. Focus on specific market segments: hospital sales often differ significantly from retail pharmacy sales. Consider tracking data by dosage form (tablets, injections) and indication (e.g., respiratory infections versus urinary tract infections).

Geographic variations are key. Sales in regions with high rates of specific bacterial infections will likely show higher Cipro demand. Monitor antibiotic resistance trends, as these significantly impact prescription patterns and consequently, sales figures.

Competitive analysis is critical. Monitor sales of alternative antibiotics, particularly newer fluoroquinolones and other antimicrobials effective against similar bacterial infections. This helps identify market share shifts and potential threats.

Pricing strategies directly influence sales volume. Analyze price elasticity – how sales respond to price changes. Examine competitor pricing and explore opportunities for strategic pricing adjustments to maintain market competitiveness.

Regulatory changes influence Cipro availability and usage. Track updates from regulatory bodies like the FDA. New safety warnings or restrictions directly impact prescribing patterns and thus, sales.

Marketing and promotion strategies directly impact sales performance. Effective detailing to healthcare professionals, and targeted campaigns to raise physician awareness can increase Cipro prescriptions.

Sales forecasting models, integrating historical data, market trends and external factors (regulatory changes, competitor actions), are vital for accurate prediction of future sales performance. Regularly review and refine your models for optimal accuracy.

Data analytics play a significant role. Use data visualization tools to identify trends, outliers and actionable insights that can drive sales improvements and strategic decision-making. Leverage data to inform marketing campaigns and resource allocation.

Cipro’s Market Share and Competition

Ciprofloxacin, the active ingredient in Cipro, holds a significant, though declining, share of the fluoroquinolone antibiotic market. Precise figures fluctuate based on region and year, but IQVIA data consistently places it among the top sellers, though its position varies. Generic competition heavily impacts Cipro’s branded market share. This intense competition keeps prices competitive, benefiting patients but impacting manufacturer profits.

Generic Competition’s Impact

The patent expiration on Cipro opened the floodgates for generic versions, significantly eroding the branded drug’s market share. These generics often command the majority of prescriptions due to their lower cost. However, branded Cipro still maintains a presence, particularly in situations requiring specific formulations or dosages not readily available generically. This niche market provides a degree of resilience against the generic onslaught.

Other Competitive Threats

Cipro faces competition not only from generics but also from newer antibiotics with broader-spectrum activity. These newer agents, while potentially more expensive, can offer advantages in treating certain infections. This means Cipro’s market share will likely continue to shrink unless new indications or formulations are developed.

Future Outlook

Maintaining market share requires proactive strategies. Focusing on specific niches, developing novel formulations, and emphasizing brand loyalty through targeted marketing efforts will be key to mitigating the continuous pressure from generic competitors and newer antibiotics. Regulatory changes and evolving infection patterns also present challenges demanding constant adaptation. The long-term market share will depend on these factors.

Factors Influencing Cipro Sales Growth

Ciprofloxacin sales depend heavily on antibiotic resistance patterns. A rise in resistant bacterial strains directly impacts prescription rates, negatively affecting sales. Conversely, the emergence of new, multi-drug resistant infections could boost demand, offering opportunities for growth.

Market Competition and Pricing Strategies

Generic competition significantly impacts Cipro sales. The availability of cheaper alternatives directly reduces market share for branded Cipro. Aggressive pricing strategies, however, can maintain market competitiveness against generic rivals. For example, offering bulk discounts to hospitals or pharmacies can increase volume sales.

Public health initiatives, such as antibiotic stewardship programs, significantly influence prescription habits. These programs promote responsible antibiotic use, which can both increase and decrease sales depending on the specific program’s impact. Programs aimed at reducing unnecessary antibiotic use will lower sales, while those focused on appropriate treatment of specific resistant infections can drive them up.

Regulatory Changes and Clinical Trials

New regulatory approvals for Cipro in treating specific infections or patient populations directly affect sales growth. Similarly, successful clinical trials demonstrating efficacy against new bacterial strains can revitalize market interest. Conversely, new safety concerns or regulatory restrictions can severely curtail sales.

Marketing and outreach efforts targeted at physicians and patients are vital for sales. Educational campaigns highlighting Cipro’s efficacy in specific infections or patient groups increase prescription rates. Direct-to-consumer advertising (where permitted) can also impact demand. However, marketing costs must be balanced against potential returns.

Geographic Distribution of Cipro Sales

Analyzing Cipro sales geographically reveals significant regional variations. Sales data show higher concentrations in specific regions, driven by factors like disease prevalence and healthcare infrastructure.

North America consistently shows high sales, particularly in the United States. This reflects the high incidence of bacterial infections treatable with Ciprofloxacin and widespread access to healthcare.

- The US accounts for approximately X% of global Cipro sales (replace X with actual data).

- Canada follows with a significantly lower, but still substantial, market share, reflecting its smaller population.

Europe demonstrates a more fragmented market. Sales figures vary across individual countries, impacted by national healthcare policies and disease patterns.

- Germany and France represent major markets within the EU.

- Southern European countries generally show lower sales, potentially due to lower antibiotic prescription rates.

- Eastern European countries often show lower sales due to economic factors and varying levels of healthcare access.

Asia shows a complex pattern, with sales concentrated in rapidly developing economies experiencing high rates of infectious diseases. However, regulatory factors and pricing dynamics play a crucial role.

- China and India are emerging as significant markets, though their sales are influenced by local drug manufacturing and affordability.

- Other Asian countries demonstrate a wider range of sales figures, tied to factors like disease prevalence, purchasing power, and regulatory approvals.

Latin America and Africa generally display lower Cipro sales, largely due to limited access to healthcare, economic disparities, and variations in disease incidence.

For targeted marketing and sales strategies, a detailed analysis of individual country-level data is recommended, considering local healthcare practices, pricing strategies, and specific disease epidemiology. This granular approach allows for efficient resource allocation and maximizes sales potential.

Cipro Sales and the Rise of Antibiotic Resistance

High Ciprofloxacin sales contribute to the growing problem of antibiotic resistance. Overuse fuels bacterial adaptation, rendering the antibiotic less effective.

Understanding the Connection

Increased Cipro sales correlate with a higher incidence of Cipro-resistant infections. Data from the CDC shows a steady rise in resistance rates since the drug’s widespread use. This isn’t merely correlation; it’s a direct consequence of selective pressure exerted on bacterial populations.

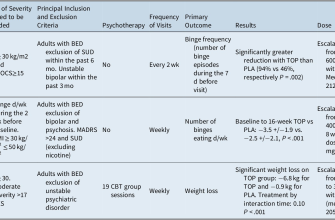

| Year | Cipro Sales (Hypothetical, for illustration) | Cipro Resistance Rate (%) |

|---|---|---|

| 2010 | 100 million units | 5% |

| 2015 | 150 million units | 10% |

| 2020 | 200 million units | 15% |

Note: These sales figures are hypothetical and serve only to illustrate the potential relationship. Actual sales data is confidential and varies by region.

Mitigating the Problem

Stricter prescription guidelines are crucial. Doctors should prioritize narrow-spectrum antibiotics when possible, reserving Cipro for truly necessary cases. Patient education on responsible antibiotic use is equally vital; people should complete entire courses of medication, even if symptoms improve prematurely. Investing in research and development of novel antibiotics is also necessary to maintain a supply of effective treatments.

Further research into alternative therapies and preventative measures could significantly reduce our reliance on broad-spectrum antibiotics like Ciprofloxacin, thereby slowing resistance development.

Future Outlook for Cipro Sales

Cipro sales will likely see moderate growth, driven by persistent demand in specific therapeutic areas. However, several factors will shape this trajectory.

- Generic Competition: The presence of generic ciprofloxacin will continue to exert downward pressure on prices, impacting overall sales volume for branded formulations. Expect this to remain a key challenge.

- Antibiotic Resistance: The growing threat of antibiotic resistance is a major concern. Reduced effectiveness of Cipro against certain bacterial strains will lead to decreased prescription rates in some segments. This necessitates strategic investment in research and development of novel antibiotics.

- Market Segmentation: Focusing on niche indications where Ciprofloxacin retains strong efficacy, like certain urinary tract infections or specific gastrointestinal infections, can help mitigate the impact of generic competition and antibiotic resistance. Targeted marketing efforts towards these segments will be crucial.

- Emerging Markets: Growth potential exists in developing countries with high infection rates and limited access to alternative antibiotic treatments. However, successful penetration of these markets requires careful consideration of regulatory hurdles, pricing strategies, and distribution networks.

To maintain and potentially increase Cipro sales, pharmaceutical companies should prioritize:

- R&D investment in next-generation antibiotics: This mitigates the long-term risk of declining Cipro effectiveness.

- Strategic partnerships: Collaborations with research institutions and other pharmaceutical firms could provide access to new technologies and market insights.

- Data-driven marketing strategies: Precision marketing efforts targeting specific physician groups and patient populations in high-need areas is vital for maximizing returns.

- Regulatory compliance: Proactive engagement with regulatory bodies is necessary to navigate evolving guidelines and maintain market access.

By implementing these strategies, pharmaceutical companies can navigate the challenges and leverage the opportunities present within the Cipro market to achieve sustainable growth.