Explore Exelon’s financial performance through their detailed quarterly and annual reports. These reports offer a transparent view into their operational efficiency, including key performance indicators (KPIs) like revenue, earnings per share (EPS), and debt levels. Directly accessing these documents on their investor relations website provides immediate access to the data you need.

Actively engage with Exelon’s investor relations team. Schedule a call or attend their upcoming investor events – they regularly host webcasts and conferences detailing their strategic vision and financial projections. Direct engagement offers valuable insights into management’s plans and allows for direct Q&A sessions.

Analyze Exelon’s sustainability initiatives. Their commitment to clean energy directly impacts their long-term financial outlook. Review their ESG (Environmental, Social, and Governance) reports for data on emissions reductions, renewable energy investments, and social impact programs; these factors increasingly influence investor decisions and long-term value.

Compare Exelon’s performance against industry competitors. Benchmarking their financial metrics and operational strategies against similar companies reveals comparative advantages and potential risks. This comparative analysis helps make informed investment decisions based on relative strength and market positioning. Consider utilizing publicly available financial databases for this crucial step.

- Exelon Investor Relations: A Detailed Overview

- Understanding Exelon’s Financial Performance

- Analyzing Key Financial Ratios

- Analyzing Exelon’s Dividend Policy and Shareholder Returns

- Navigating Exelon’s Investor Communication Channels

- Key Resources on Exelon’s Investor Relations Website

- Beyond the Website

- Evaluating Exelon’s Long-Term Growth Prospects and Risks

- Renewable Energy Portfolio & Regulatory Landscape

- Nuclear Power Plant Operations and Decommissioning

- Market Competition and Pricing

- Debt and Financial Health

- Recommendation

Exelon Investor Relations: A Detailed Overview

Find Exelon’s investor relations materials on their dedicated website. This includes quarterly and annual reports, SEC filings, presentations from investor conferences, and webcasts of earnings calls.

Contact Exelon’s Investor Relations department directly with specific questions. Their contact information–including phone numbers and email addresses–is readily available on their investor relations page.

Utilize Exelon’s online resources to access their financial data. This includes key financial metrics, historical stock performance, and dividend information. Regularly review these resources to stay informed about the company’s financial health.

Follow Exelon on social media platforms like Twitter and LinkedIn for timely updates on news and announcements relevant to investors. However, always verify this information with official sources before making any investment decisions.

Analyze Exelon’s sustainability reports to understand their environmental, social, and governance (ESG) performance. This information can be valuable for ESG-conscious investors.

Consider consulting with a financial advisor before making investment decisions related to Exelon. A professional can help you assess your risk tolerance and investment goals.

Review analyst reports and ratings on Exelon from reputable financial institutions. These reports offer independent perspectives on the company’s performance and outlook.

Attend Exelon’s investor events, such as earnings calls and investor conferences, when possible. This offers direct access to management and opportunities to ask questions.

Monitor Exelon’s press releases for significant developments that could impact their stock price. These announcements often contain crucial information for investors.

Regularly check Exelon’s stock price and trading volume using reputable financial websites or your brokerage account. This allows you to track performance and market sentiment.

Understanding Exelon’s Financial Performance

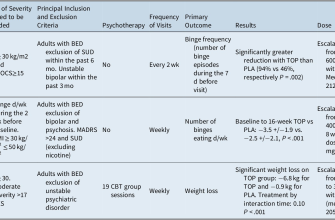

Analyze Exelon’s financial reports, focusing on key metrics like revenue, earnings per share (EPS), and operating cash flow. Review quarterly and annual reports available on their investor relations website for detailed breakdowns. Pay close attention to trends in these figures over several years to identify growth patterns or potential concerns.

Analyzing Key Financial Ratios

Calculate and track key financial ratios such as return on equity (ROE), debt-to-equity ratio, and free cash flow margin. These ratios provide valuable insight into Exelon’s profitability, financial leverage, and ability to generate cash. Comparing these ratios to industry averages and competitors helps gauge Exelon’s relative financial strength.

Examine Exelon’s segment performance, separating the contributions of their generation, transmission, and distribution businesses. This allows investors to understand which segments drive profitability and identify potential risks or opportunities within specific areas. Scrutinize management’s discussion and analysis (MD&A) section within financial reports for deeper understanding of performance drivers.

Consider the impact of regulatory changes and energy market dynamics on Exelon’s financial results. Regulatory decisions and evolving energy policies significantly influence the company’s operations and profits. Monitor legislative developments and their potential effect on Exelon’s future earnings.

Analyzing Exelon’s Dividend Policy and Shareholder Returns

Exelon’s dividend policy prioritizes consistent payouts, offering a reliable income stream for investors. Examine the historical dividend growth rate to gauge its sustainability. Consider comparing this rate to industry averages and peer company performance. A declining growth rate warrants further investigation into Exelon’s financial health and future prospects.

Scrutinize Exelon’s payout ratio–the percentage of earnings distributed as dividends. A high payout ratio might indicate a commitment to shareholders but also raises concerns about reinvestment in growth opportunities. A lower ratio suggests more resources available for future expansion and potentially stronger long-term growth. Analyze the company’s free cash flow to determine their ability to sustain dividend payments even during periods of low profitability.

Shareholder returns encompass both dividend payments and capital appreciation. Track Exelon’s stock price performance relative to its industry benchmarks. Analyze factors contributing to price movements, such as regulatory changes, market sentiment, and the company’s operational performance. Long-term investors should assess the total return, combining dividend income and capital gains, for a comprehensive evaluation of shareholder returns.

Evaluate Exelon’s debt levels and credit rating. High levels of debt can constrain future dividend increases and potentially threaten the sustainability of current payments. A strong credit rating generally signifies lower risk and improved stability of dividend payouts. Consult analyst reports and financial news for up-to-date assessments of Exelon’s financial stability.

Finally, compare Exelon’s dividend policy and shareholder returns with those of comparable utilities. This comparative analysis offers valuable perspective on Exelon’s relative performance and highlights potential areas of strength or weakness. Remember to consider various perspectives and utilize a range of financial data when making investment decisions.

Navigating Exelon’s Investor Communication Channels

Find Exelon’s investor information directly on their website, specifically the “Investor Relations” section. This is your central hub.

Key Resources on Exelon’s Investor Relations Website

- Financial Reports: Access quarterly and annual reports, including 10-Ks and 10-Qs, providing detailed financial performance data.

- SEC Filings: Locate all SEC filings, ensuring transparency and regulatory compliance information.

- Presentations: Review investor presentations from conferences and meetings, offering insights into Exelon’s strategic direction.

- Webcasts & Transcripts: Listen to or read transcripts from earnings calls and other important investor events. Check the schedule for upcoming events.

- News Releases: Stay informed about company announcements, press releases, and material events affecting the company.

- Contact Information: Find the appropriate contact details for investor inquiries, providing direct access to the Investor Relations team.

Subscribe to Exelon’s email alerts to receive immediate notification of significant news and updates.

Beyond the Website

- Financial News Outlets: Monitor reputable financial news sources for Exelon-related articles and analysis. Bloomberg, Reuters, and the Wall Street Journal are good starting points.

- Analyst Reports: Research reports from financial analysts offer independent perspectives on Exelon’s performance and future prospects. Access these through your brokerage account or financial research databases.

- Investor Conferences: Attend industry conferences where Exelon executives often present and engage with investors. Check Exelon’s website for their conference schedule.

Utilize these channels strategically to stay informed and make well-informed investment decisions. Remember to always verify information from multiple sources.

Evaluating Exelon’s Long-Term Growth Prospects and Risks

Exelon’s future hinges on its ability to navigate the energy transition successfully. This requires a keen focus on several key areas. Specifically, their investment in renewable energy sources like wind and solar will significantly impact long-term growth. Current projections show a substantial increase in renewable energy capacity by 2030, but achieving this depends on securing necessary permits and facing potential regulatory hurdles.

Renewable Energy Portfolio & Regulatory Landscape

Analyzing Exelon’s success in securing permits and navigating the regulatory maze is critical. Compare their application approval rates to competitors. Examine the timeline for bringing new renewable projects online; delays could significantly impact projected growth. The regulatory environment is dynamic, so understanding upcoming legislation and its potential effect on their renewable energy projects is paramount.

Nuclear Power Plant Operations and Decommissioning

Exelon’s nuclear power plants form a substantial part of its current revenue. The longevity and operational efficiency of these plants directly influence their short-term and long-term financial performance. Assess plant performance metrics, maintenance schedules and projected lifespan. Simultaneously, monitor the progress and costs associated with decommissioning older plants, a significant financial undertaking with long-term implications.

Market Competition and Pricing

The electricity market is highly competitive. Exelon faces competition from both traditional and renewable energy sources. Examine their market share trends and pricing strategies. Understanding how effectively they compete on price and service will be key. Analyze their diversification strategy–their ability to offer a range of energy services, not just power generation, helps mitigate risk.

Debt and Financial Health

Exelon’s financial health is a crucial factor in assessing long-term prospects. A high debt-to-equity ratio poses a significant risk. Analyze the company’s debt levels, credit rating, and ability to service its debt. Consider the potential impact of interest rate fluctuations on their financial position. A strong financial foundation allows for greater investment in growth opportunities.

Recommendation

Investors should conduct thorough due diligence, focusing on the above areas before making investment decisions. Analyzing the interplay of these factors, rather than looking at them in isolation, provides a more accurate picture of Exelon’s long-term prospects and potential risks.