Need to know if your Blue Cross Blue Shield plan covers Levitra? Check your formulary. Most plans include it, but specific coverage depends on your plan’s tier and any prior authorizations needed. Contact your plan administrator directly for precise details regarding your copay and any restrictions.

Many plans place Levitra in a tiered system; this means your out-of-pocket cost will vary depending on the tier. Generic alternatives may be cheaper, and your doctor might suggest exploring those options to reduce your costs. Always discuss medication cost with your pharmacist, too, as they often know about available coupons and programs.

Remember to confirm your prescription coverage before receiving your Levitra prescription. Understanding your benefits beforehand prevents unexpected expenses. Pre-authorization may be required for certain plans; if so, your doctor’s office should initiate this process for you. This simple step ensures a smoother process and helps avoid potential delays.

Proactive communication with your insurance provider is key. Don’t hesitate to call their member services line for clarification on any points regarding your coverage. They can provide the most accurate and up-to-date information about your specific plan’s policy concerning Levitra.

- Levitra and Blue Cross/Blue Shield Coverage

- Finding Your Plan’s Formulary

- Understanding Prior Authorization

- Exploring Cost-Saving Options

- Contacting Blue Cross/Blue Shield

- Understanding Your Blue Cross/Blue Shield Plan

- Levitra Coverage Variations by Plan Type

- HMO Plans

- PPO Plans

- EPO Plans

- Medicare Plans

- Important Note:

- Prior Authorization Requirements for Levitra

- Gathering Necessary Information

- Understanding Potential Delays

- Generic Vardenafil and Blue Cross/Blue Shield

- Finding Coverage Information

- Exploring Cost-Saving Options

- Cost-Sharing with Blue Cross/Blue Shield: Copay, Deductible, and Coinsurance

- Finding Affordable Levitra Options with Blue Cross/Blue Shield

- Alternatives to Levitra Covered by Blue Cross/Blue Shield

- Other Potential Options

- Contacting Blue Cross/Blue Shield for Specific Coverage Details

Levitra and Blue Cross/Blue Shield Coverage

Check your specific Blue Cross/Blue Shield plan’s formulary. This document lists covered medications. Levitra’s inclusion varies widely depending on your plan type and location.

Finding Your Plan’s Formulary

- Visit your insurer’s website. Use the member portal to access your formulary.

- Contact your plan administrator directly via phone or email. Ask for a copy of the formulary or inquire about Levitra coverage.

- Review your plan’s welcome packet or any related paperwork. The formulary may be included there.

Prior authorization might be required. This means your doctor needs to obtain pre-approval from Blue Cross/Blue Shield before your prescription is covered. The requirements for prior authorization vary greatly by plan.

Understanding Prior Authorization

- Confirm whether prior authorization is needed for Levitra under your plan.

- If required, work with your doctor to submit the necessary paperwork. This often involves explaining the medical necessity of Levitra.

- Allow sufficient processing time. The approval process can take several days or even weeks.

Generic alternatives may be cheaper. Your doctor might suggest a generic medication, like vardenafil, if your plan covers it more favorably than Levitra.

Exploring Cost-Saving Options

- Discuss generic options with your physician.

- Explore your plan’s patient assistance programs. These programs might offer financial aid.

- Inquire about manufacturer coupons or savings cards. These can reduce your out-of-pocket expenses.

Remember, coverage details are subject to change. Always refer to the most updated formulary and contact your insurance provider for the most accurate information.

Contacting Blue Cross/Blue Shield

Your Blue Cross/Blue Shield plan’s customer service number is usually available on your insurance card or website. Don’t hesitate to call them for clarification on your specific policy.

Understanding Your Blue Cross/Blue Shield Plan

Check your plan’s formulary. This document lists covered medications and their cost-sharing details. You’ll find it on your insurer’s website or by contacting member services.

Confirm Levitra’s coverage. Search your formulary for “vardenafil” (Levitra’s generic name). Note the tier level (e.g., Tier 1, Tier 2). Higher tiers mean higher out-of-pocket costs.

- Prior Authorization: Some plans require prior authorization before covering Levitra. Your doctor may need to submit a request. Check your formulary for this requirement.

- Step Therapy: Your plan might require you to try less expensive medications first. This is outlined in your formulary; discuss alternatives with your doctor.

- Generic Options: Consider generic vardenafil. It’s usually cheaper than brand-name Levitra and equally effective. Your doctor can discuss this option.

Review your cost-sharing responsibilities. Understand your copay, coinsurance, and deductible. These details influence your overall medication cost.

- Contact your Blue Cross/Blue Shield plan directly. A representative can provide detailed information about Levitra coverage under your specific plan.

- Use your plan’s online tools. Most plans have member portals with cost estimators and benefit summaries.

- Review your Explanation of Benefits (EOB) statements. These documents explain payments made and costs incurred.

Compare your options. If Levitra’s cost is high, discuss alternative treatments or medications with your doctor. They can help you find affordable solutions.

Levitra Coverage Variations by Plan Type

Check your specific Blue Cross Blue Shield plan documents or contact your provider directly for precise details. Coverage varies widely based on your plan’s formulary and your individual circumstances. Generally, however, expect differences among plan types.

HMO Plans

HMO plans often require you to use in-network providers and may have stricter prior authorization requirements for Levitra. This means you might need your doctor to justify the prescription before coverage is granted. Generic alternatives are often preferred over brand-name Levitra to reduce costs.

PPO Plans

PPO plans usually offer more flexibility in choosing doctors, including out-of-network providers. While you’ll likely pay less when using in-network physicians, out-of-network costs for Levitra might be significantly higher. Pre-authorization procedures are often less stringent than with HMOs.

EPO Plans

Exclusive Provider Organization (EPO) plans are similar to HMOs in requiring you to use in-network providers. However, unlike HMOs, some EPO plans might allow limited out-of-network care, though often at a much higher cost. Levitra coverage will likely follow the same pattern as HMO plans, emphasizing in-network care and potential generic substitutions.

Medicare Plans

Medicare Part D prescription drug plans cover Levitra, but coverage specifics depend on the individual plan. Expect co-pays and formularies to influence your out-of-pocket costs. Consult your Part D plan’s formulary for exact details regarding Levitra coverage and cost-sharing.

Important Note:

Always confirm your prescription drug coverage with your insurance provider. This information serves as general guidance only and doesn’t replace personalized plan details.

Prior Authorization Requirements for Levitra

Contact your Blue Cross Blue Shield plan directly. Their specific requirements vary by plan and location. You’ll find the most accurate and up-to-date information on their website or by calling their member services line. Look for sections on “prior authorization,” “pre-authorization,” or “formulary.”

Gathering Necessary Information

To expedite the process, gather your prescription details, including dosage and quantity, along with your doctor’s contact information. Be prepared to answer questions about your medical history and the reason for Levitra prescription. Some plans may require additional documentation, such as clinical notes supporting medical necessity. Check your plan’s website for a detailed list of required documents.

Understanding Potential Delays

Processing time for prior authorization requests can range from a few days to several weeks. Submit your request well in advance of needing the medication to minimize potential delays. If you encounter problems, follow up with your insurance provider to track your request’s status. Timely communication is key.

Generic Vardenafil and Blue Cross/Blue Shield

Coverage for generic vardenafil under Blue Cross/Blue Shield plans varies significantly. Your specific plan’s formulary determines whether it’s covered and at what cost-sharing level. Check your plan’s drug formulary online or contact your plan administrator directly for the most accurate information. They can provide details on your copay, deductible, and any prior authorization requirements.

Finding Coverage Information

Your Blue Cross/Blue Shield plan website usually has a search function to quickly check if generic vardenafil is covered. Look for a section called “Formulary,” “Drug List,” or “Pharmacy Benefits.” Enter “vardenafil” as the search term. If you can’t find the information online, call the member services number on your insurance card. Be prepared to provide your plan details and the medication name.

Exploring Cost-Saving Options

If your plan doesn’t fully cover generic vardenafil, explore options like using a mail-order pharmacy, which might offer lower prices. Also, ask your doctor about alternative medications or coupons that could reduce your out-of-pocket costs. Compare prices at various pharmacies to find the best value. Remember, price can change, so always double-check before filling a prescription.

Cost-Sharing with Blue Cross/Blue Shield: Copay, Deductible, and Coinsurance

Check your specific Blue Cross/Blue Shield plan details – your costs depend entirely on your individual policy. Your plan documents or member portal clearly outline your cost-sharing responsibilities.

Your copay is a fixed amount you pay each time you visit a doctor or fill a prescription. This amount varies based on your plan tier and the type of service. Higher-tier plans often have higher copays, but lower out-of-pocket maximums.

Before your insurance starts covering most expenses, you must meet your deductible. This is an annual amount you pay out-of-pocket. Once you meet it, your plan’s coverage begins.

Coinsurance is the percentage of costs you pay after you’ve met your deductible. For example, an 80/20 coinsurance means you pay 20% of the expenses; your plan covers the remaining 80%. The coinsurance percentage is determined by your plan’s specific design.

To understand your total cost for Levitra, add your copay (if applicable), your portion of the deductible, and your coinsurance percentage of the remaining costs. Remember, prior authorization may be required for certain medications, potentially impacting your out-of-pocket costs. Contact your plan administrator or pharmacist for specific details on your medication’s coverage.

Use the online tools and resources provided by your Blue Cross/Blue Shield plan for personalized cost estimates. These tools help you predict your expenses and make informed decisions.

Finding Affordable Levitra Options with Blue Cross/Blue Shield

Check your Blue Cross/Blue Shield plan’s formulary. This document lists covered medications and their associated tiers. Levitra’s placement determines your out-of-pocket cost.

Explore your plan’s preferred pharmacies. Using a network pharmacy often results in lower costs compared to out-of-network options. Your plan’s website or member services can provide this list.

Consider using a 90-day prescription. While the upfront cost is higher, the per-pill price is usually lower than with a 30-day supply. This strategy saves money over time.

Inquire about manufacturer coupons or savings programs. Companies often offer assistance programs to reduce medication expenses. Check the Levitra manufacturer’s website for details.

Discuss generic alternatives with your doctor. If a generic version of Levitra (vardenafil) exists and is covered by your plan, it will likely be less expensive.

Negotiate a payment plan. If cost remains a barrier, contact your pharmacy or insurance provider to discuss flexible payment options.

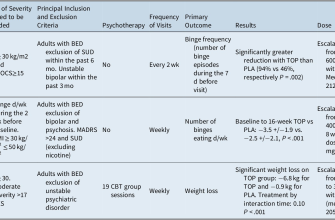

| Strategy | Action | Potential Savings |

|---|---|---|

| Formulary Check | Review your plan’s formulary. | Lower copay depending on tier. |

| Network Pharmacy | Use a preferred pharmacy. | Reduced dispensing fees and lower drug costs. |

| 90-Day Supply | Obtain a 90-day prescription. | Lower per-pill cost. |

| Manufacturer Coupons | Check for manufacturer savings programs. | Direct cost reduction. |

| Generic Alternative | Discuss vardenafil with your doctor. | Significant cost savings. |

| Payment Plan | Negotiate a payment plan. | More manageable monthly payments. |

Remember to always consult your doctor before changing medications or dosages.

Alternatives to Levitra Covered by Blue Cross/Blue Shield

Blue Cross/Blue Shield coverage varies widely depending on your specific plan. Contact your plan administrator directly to confirm coverage for specific medications. However, common alternatives to Levitra (vardenafil) often covered include Viagra (sildenafil) and Cialis (tadalafil). These medications share similar mechanisms of action and treat erectile dysfunction effectively. Your doctor can help determine which medication is best suited for your individual needs and health profile.

Other Potential Options

Depending on your plan’s formulary, other PDE5 inhibitors like Stendra (avanafil) might also be covered. Always check your plan’s benefits and discuss any potential medication switches with your physician before making changes to your treatment. They can guide you towards the most appropriate and covered alternative.

Contacting Blue Cross/Blue Shield for Specific Coverage Details

Find your Blue Cross/Blue Shield plan’s member services number on your insurance card or their website. This number provides direct access to representatives who can answer your questions about Levitra coverage.

Clearly state you need information regarding Levitra coverage under your specific plan. Provide your plan name and member ID number for quicker service.

Ask about pre-authorization requirements. Some plans require prior approval before covering Levitra prescriptions. Understand any necessary steps to obtain this approval.

Inquire about cost-sharing details, including co-pays, deductibles, and coinsurance amounts related to Levitra. Ask if there are any preferred pharmacies to minimize out-of-pocket expenses.

Check if your plan includes a formulary, a list of covered medications. Verify Levitra’s placement on this formulary and any associated tiers impacting your costs.

Document the conversation, noting the representative’s name, date, and a summary of the information provided. This helps with future reference.

If you have difficulty reaching someone or obtaining a clear answer, consider contacting the plan’s customer service department via mail or online using their website’s contact form.